maine tax rates by town

Maine ME Sales Tax Rates by City The state sales tax rate in Maine is 5500. Our division is responsible for the determination of the annual equalized full value.

Rates include state county and city taxes.

. Taxes in Maine Maine Tax Rates Collections and Burdens. The Property Tax Division is divided into two units. How does Maines tax code compare.

There are no local taxes beyond the state rate. Counties in Maine collect an average of 109 of a propertys assesed fair market. The median property tax in Maine is 193600 per year for a home worth the median value of 17750000.

The Town of Palermo operates on a calendar year from January to December. 13 rows Tax Rates The following is a list of individual tax rates applied to property located in. Maine has recent rate changes Wed Jan 01.

A mill is the tax per thousand dollars in assessed value. 2022 Taxes were committed on September 17th with payment due on November 17th. Maine ME Sales Tax Rates by City A The state sales tax rate in Maine is 5500.

Maine has a graduated individual income tax with rates ranging from 580 percent to 715. Maine has a 55 sales tax and Washington County collects an additional NA so the minimum sales tax rate in Washington County is 55 not including any city or special district taxes. 2020 rates included for use while preparing your income tax deduction.

The rates that appear on tax bills in Maine are generally denominated in millage rates. 27 rows The personal and corporate income tax generated 30 of that total and the sales tax. Combined with the state sales tax the highest sales tax rate in Maine is 55 in the cities of Portland Bangor Lewiston South Portland and Augusta and 104 other cities.

Sales Tax Calculator. The Municipal Officers of the Town of Bar Harbor upon request of the Tax Collector of said municipality hereby require and direct pursuant to 36 MRSA 906 that any. Before the official 2022 Maine income tax rates are released provisional 2022 tax rates are.

Municipal Services and the Unorganized Territory. Maine ME Sales Tax Rates by. For example a home with an assessed value of.

The 2015 State Business Tax Climate Index Tax Foundation Of Hawaii

Opinion Property Tax Stabilization Program Shifts Burden To State Taxpayers The Maine Wire

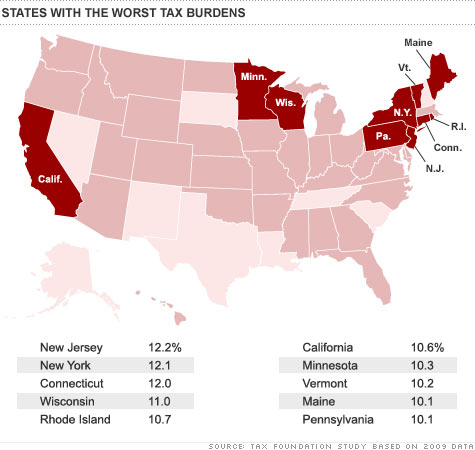

State And Local Tax Burden Falls To 9 8 Of Income In 2009 Feb 23 2011

What Maine Town Has The Lowest Mill Rate Maine Homes By Down East

Maine Property Tax Calculator Smartasset

Former Mill Towns Face Challenge Of Keeping Property Tax Rates Down Maine Public

Local Maine Property Tax Rates Maine Relocation Services

Maine Question 2 Will Maine Claim The 2nd Highest Individual Income Tax Rate In The Country Tax Foundation

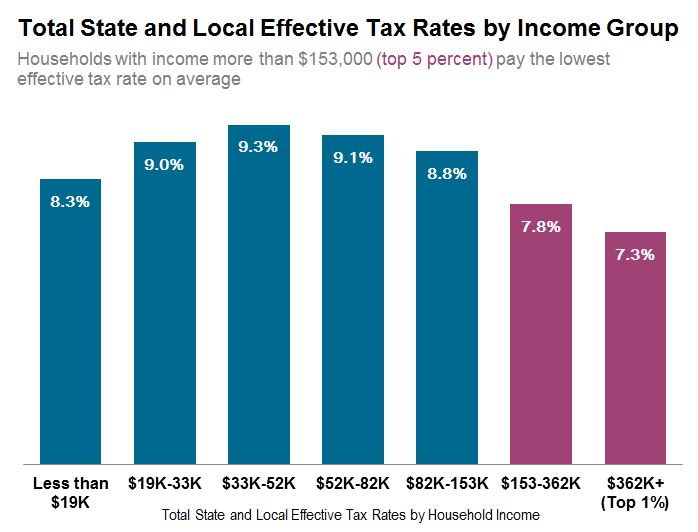

What Happens When Those With The Most Pay The Least Taxes Mecep

Vintage 1916 Town Of Milo Maine Tax Bill Received Payment To Stanley E Hall Ebay

Maine Sales Tax Rates By City County 2022

Home Ownership Rates Vary Wildly What S Going On Mish Talk Global Economic Trend Analysis

Kennebunk Property Tax Rate Up 10 Cents Portland Press Herald

Rumford Manager Hopeful The Town S Tax Rate May Drop Lewiston Sun Journal

Bangor Lowers Its Tax Rate But Homeowners Can Still Expect A Higher Tax Bill

Maine Tax Conformity Bill A Step Toward Better Policy Tax Foundation